In today’s market, low inventory dominates the conversation in many areas of the country. It can often be frustrating to be a first-time homebuyer if you aren’t prepared. Here are five tips from realtor.com’s article, “How to Find Your Dream Home—Without Losing Your Mind.”

Blog

Updates to Government’s First Home Grant

Topics: First Home Buyer, House prices, Kiwisaver withdrawal

Government recently announced changes to some of the home ownership products and programmes administered by Kāinga Ora – Homes and Communities that will take effect from 15 May 2023. By introducing changes to the First Home Grant, Government hopes to make it easier for first home buyers to build new homes or buy newly built homes. Read on to find out what the changes are as well as the opportunities these changes could present to first home buyers looking to build new or buy new.

What is the First Home Grant?

First home buyers who have been contributing to KiwiSaver for at least 3 years may be eligible for a First Home Grant of up to $10,000 to top up their deposit.

- When buying an existing home, eligible buyers may get $1,000 for each of the 3 or more years they have paid into KiwiSaver, up to a maximum of $5,000 for 5 or more years.

- When buying a new home or land to build on, eligible buyers may get $2,000 for each of the 3 or more years they have paid into KiwiSaver, up to a maximum of $10,000 for 5 or more years.

You can apply for the First Home Grant for a pre-approval before you find a home, or once you have found a home and have signed a sale and purchase agreement. House price caps and income caps apply so it’s important to check eligibility before applying.

What are the changes to the First Home Grant?

Effective 15 May 2023:

- First Home Grant house price caps will be adjusted in several areas to align with the current market.

- The minimum new build house price cap for the First Home Grant will be lifted from $500,000 to $650,000, to reflect the rising cost of construction.

- View the updated First Home Grant house price caps [PDF, 838 KB].

Find out here what the other changes are.

What qualifies as a “new build”?

The First Home Grant recognises a new build as any of the following:

- A vacant residential section on which a new dwelling will be built within specified time frames – there must be a fixed price build contract included in the application

- A house and land package purchased from plans

- A new apartment built from plans

- A newly built dwelling that has received its building code compliance certificate less than six months before the buyer’s application. This does not mean a code compliance certificate issued for renovations/additions.

- The First Home grant CANNOT be used to fund building a dwelling on land that is already owned by the KiwiSaver member.

- If you are buying land, a house and land package or an apartment off the plans, a signed fixed price building contract containing clear construction start and end dates (and a sunset clause) must accompany the application.

- The purchase price of the land + the cost of the build must be less than the regional property cap.

Building a New Home with the First Home Grant

Last year, house price caps on the First Home Grants were increased to align with lower quartile market values for new and existing properties, resulting in a strong increase in grant applications.

The number of grants paid monthly increased from 583 in December 2021 to 1051 in December 2022, while the number of home loans each month rose from 70 to 296 over the same period of time.

It’s hoped that the most recent changes to house price caps will open up more opportunities for first home buyers who may not have considered building a new home instead of buying an existing home.

The benefits of building new include:

- Improved energy efficiency and comfort

- A home that is customised to your requirements

- Fewer running costs

- A bigger boost to your deposit from the First Home Grant

- And an exemption from Loan to Value Requirements (LVR) as determined by the Reserve Bank of New Zealand

Financial solutions for first home buyers

Buying a first home can feel like a daunting process so it’s helpful to know you have someone on your side who can guide you every step of the way, explain the processes and procedures, and ensure you have the information you need to make an informed decision about your finances.

Working with a Mortgage Express branded mortgage adviser can put you in the right position to buy a first home, with advice around saving a deposit, accessing Government support, and getting help from family and friends.

Are Auctions still a viable way to sell property?

Topics: Auctions, Home loan pre-approval, Buying and selling0

Auctions have long been one of the most popular methods for selling property in New Zealand, but with the changing landscape of the property market, many sellers are questioning whether auctions are still viable. Recent auction figures show a steep decline in sales, providing a glimpse into how the property market is shaping up in the first half of 2023. Read on to find out the pros and cons of selling at auction, as we examine what’s happening in the current property market.

Pros of Selling at Auction

There are several reasons why sellers choose to sell property in New Zealand by auction. One of the most significant is that auctions tend to generate competitive bidding, leading to potentially higher sales prices.

There’s a bit of a buzz around auctions, which helps to draw attention to the property. This is especially useful if the property is unique or has a particular appeal that may not be immediately apparent to potential buyers.

Another advantage of selling at auction is that it’s a fixed timeframe which can generate a feeling of urgency amongst potential buyers. Having a deadline often leads buyers to feeling like they may miss out if they don’t decide quickly, which can generate more bids and push up sales prices.

Because the auction process is transparent, it provides a level playing field for all bidders and, because selling at auction is an unconditional sale, it offers certainty for the seller. Once the hammer falls, the sale is final, and the seller can move on to their next venture.

Cons of Selling at Auction

While there are certainly advantages to selling at auction, there are also some potential drawbacks. One of the disadvantages is the potential for low turnout or low bidding, something we’re seeing a bit more of in the current property market. If there aren’t enough bidders, the property may sell for less than it’s worth or be passed in and remain unsold.

Another potential disadvantage is the pressure on buyers to bid higher than they intended. This pressure can be due to the competitive nature of the auction process, or it may be down to the auctioneer’s tactics. It can lead to buyers feeling like they’ve overpaid for the property, leading to buyer’s remorse.

Because auctions are unconditional, there is limited opportunity for negotiation and the sale is final at the fall of the hammer. For buyers, that means completing due diligence ahead of the auction, with the possibility of paying for these costs but missing out on auction day.

Current Property Market in New Zealand

It’s been a quiet start to 2023 for auction activity in New Zealand, with financial website interest.co.nz reporting just one in four properties being sold under the hammer in February 2023, with the remaining either being passed-in, postponed, or withdrawn from sale.

Across New Zealand, auction results have been mixed with some auctions still achieving high levels of bidding and sales figures well above the reserve price, while others are seeing low turnouts or low bidding with many properties not selling at all.

While auctions remain a viable way to sell property in New Zealand, providing a transparent and competitive process that can lead to potentially higher prices, in the current property market there may be drawbacks. It’s worthwhile seeking advice from an experienced real estate agent as to the best method of sale in your area and for your property if you are considering selling.

For financial advice around securing bridging finance to see you through selling your existing home while buying a new home, contact a Mortgage Express branded mortgage adviser today.

Reference : https://www.mortgage-express.co.nz/blog/selling-property-nz-auctions

Buying and selling at auctions.

Topics: Auctions, Selling, Buying, NZ Finance, Home Loan Advice0

Across New Zealand, auctions are a popular method for both buying and selling property. But an auction can seem daunting, particularly if you’re a first home buyer or new to the auction process. Don’t be put off though as there are many advantages for both buyer and seller. In this month’s property article, we’re sharing some of Harcourts New Zealand’s tips to buying and selling at auction to ensure you’re successful.

Selling at auction

For a seller, an auction provides an opportunity to achieve the best price in the market in the shortest possible time. Auctions are often fast-paced with buyers bidding against each and driving up the sales price. Here are some of the other advantages to selling at auction:

• Marketing without a fixed price increases the number of cash-in-hand buyers who will look at your property.

• Buyers come to an auction with their maximum price in mind as opposed to focusing on how low they can negotiate the price down to.

• Auctions attract the best buyers in the market, the ones that are cashed up and ready to purchase on the day without imposing any conditions on the seller.

(A third of all conditional contracts fail to result in a sale which can be discouraging.)

Your Harcourts sales consultant will be able to guide you through the pre-auction and auction process and explain things like:

• What’s happening in the market, specifically in your area and with properties that are similar to yours.

• All elements of your marketing plan, from the images and text for the advertising through to the scheduling of open homes.

• Daily updates and weekly face-to-face meetings.

• A written report on the marketing campaign and interest from prospective buyers.

• Setting a realistic reserve price.

Buying at auction

Many home buyers believe that the auction process only favours the seller, but that’s not the case. Buying at auction means you know exactly who your competition is and all negotiations are done out in the open for everyone to see. If your bid is successful, the contract is signed then and there, and property is yours with no further negotiations.

To make the auction process work for you, it’s important to arrive with your homework done. Here are some suggestions on how to prepare to buy at auction:

1. Have your finances organised prior to the auction date so you know exactly what you can afford to bid. If you’re successful on the day, you’ll be asked to sign the sales agreement and pay a deposit, which is typically 10% of the purchase price. Talk to your Mortgage Express adviser about securing a pre-approval before you attend an auction.

2. Organise a building inspection of the property you’re bidding on and have your solicitor review the property title and all legal matters related to the prospective purchase.

3. Review the auction documents beforehand.

4. Research the local market so you can accurately assess the market value of the property. You may also wish to obtain an independent property valuation.

5. If you’re new to the auction process, attend a few auctions to see what goes on before attending the one for the property you’re interested in.

6. A buyer can submit a pre-auction offer to the property owner for their consideration. If they are willing to accept the offer, the auction date may be brought forward.

It’s important to let the sales consultant know you are interested in the property so if another purchaser submits a pre-auction offer and the auction is moved forward, you’ll be contacted. The reserve is set at the offer figure and the auction starts with that as the opening bid. If no higher bids are received, the property is sold at the offered price. But if other buyers bid, the property will be sold to the highest bidder.

Regardless of whether you’re a buyer or seller, the more research and preparation you do prior to auction, the more likely you are to put your best foot forward on auction day.

For a free, no-obligation appraisal of your existing property, simply complete this form and a Harcourts representative in your area will be in touch to arrange an inspection of your home at a time that is convenient for you.

For advice around pre-approval or home loan finance options, get in touch with Mortgage Express.

Reference:

https://content.harcourts.co.nz/blog/the-insiders-guide-to-buying-or-selling-at-auction

Market Snapshot, New Zealand

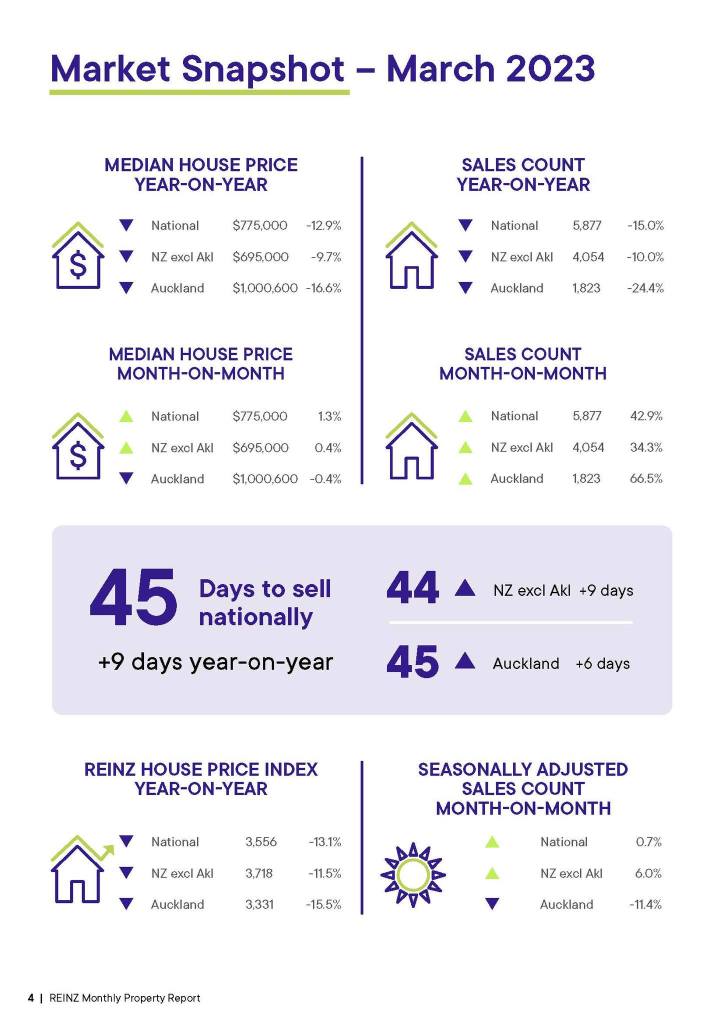

Here is a snapshot of the New Zealand market. The Real Estate Institute of New Zealand’s (REINZ) March 2023 figures show the continuing impacts of the economic climate with median prices and sales counts easing and properties taking longer to sell.

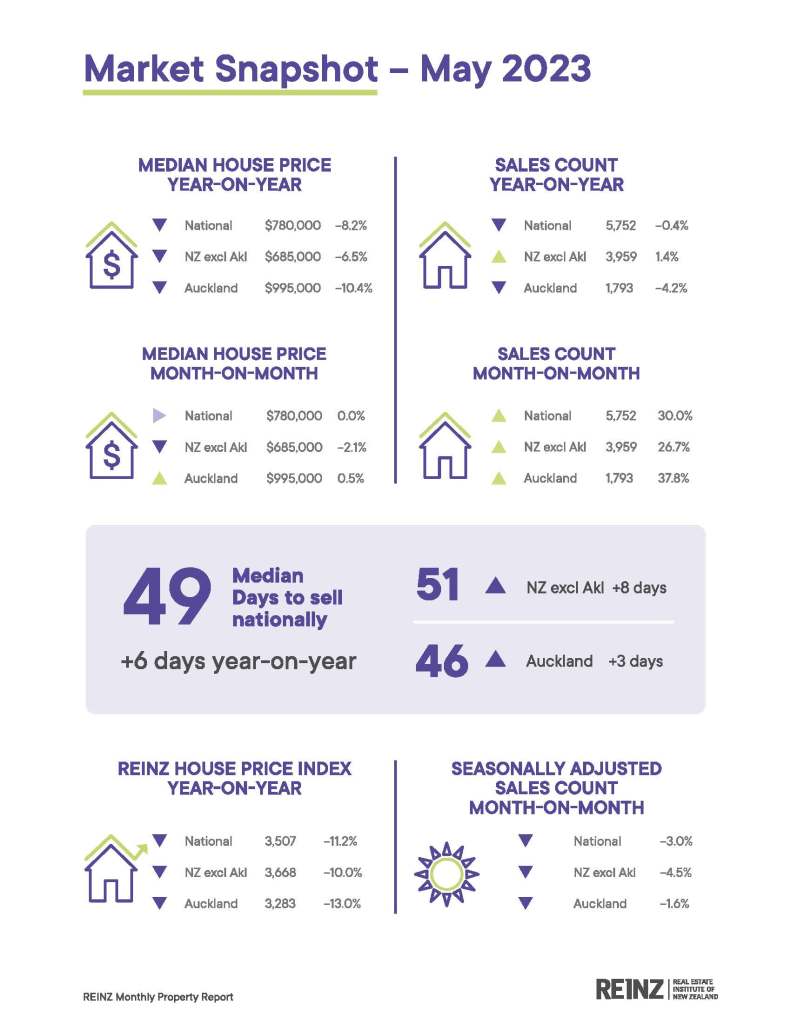

Here is a snapshot of the New Zealand market. The Real Estate Institute of New Zealand’s (REINZ) May 2023 figures. Quoting REINZ Chief Executive, Jen Baird. “As we head into the winter months, we are seeing glimpses of positivity, especially in the regions following the Reserve Bank’s announcement of easing loan-to-value restrictions and the stabilising of interest rates.

It’s clear that current high interest rates combined with a tight economy, are still influencing the market as buyers continue to act with caution while economic headwinds play out. This month median prices eased at a slower rate and sales counts are marginally down compared to May 2022. Seven regions increased in sales counts, an indicator of returning market.

Knowledge is power when it comes to appraisals and inspection

Buyers in today’s market often have questions about the importance of getting a home appraisal and an inspection. That’s because high buyer demand and low housing supply are driving intense competition and leading some buyers to consider waiving those contingencies to stand out in the crowded market.

But is that the best move? Buying a home is one of the most important transactions in your lifetime, and it’s critical to keep your best interests in mind. Here’s a breakdown of what to expect from the appraisal and the inspection, and why each one can potentially save you a lot of time, money, and headaches down the road.

Home Appraisal

The home appraisal is a critical step for securing a mortgage on your home. As Home Light explains:

“. . . lenders typically require an appraisal to ensure that your loan-to-value ratio falls within their underwriting guidelines. Mortgages are secured loans where the lender uses your home as collateral in case you default on the agreed-upon payments.”

Put simply: when you apply for a mortgage, an unbiased appraisal – typically required by your lender – is the best way to verify the value of the home. That appraisal ensures the lender doesn’t loan you more than what the home is worth.

When buyers are competing like they are today, bidding wars and market conditions can push prices up. A buyer’s contract price may end up higher than the value of the home – this is known as an appraisal gap. In today’s market, it’s common for the seller to ask the buyer to make up the difference when an appraisal gap occurs. That means, as a buyer, you may need to be prepared to bring extra money to the table if you really want the home.

Don’t Wait to Sell Your House

We’re in the ultimate sellers’ market right now. If you’re a homeowner thinking about selling, you have a huge advantage in today’s housing market. High buyer demand paired with very few houses for sale makes this the optimal time to sell for those who are ready to do so. Whatever the move you want to make looks like, here’s an overview of what’s creating the prime opportunity to sell this summer.

High Buyer Demand

Demand is strong, and buyers are actively searching for homes to purchase. In the Realtors Confidence Index Survey published monthly by the National Association of Realtors (NAR), buyer traffic is considered “very strong” in almost every state. Homebuyers aren’t just great in number right now – they’re also determined to find their dream home. NAR shows the average home for sale today receives five offers from hopeful buyers. These increasingly frequent bidding wars can drive up the price of your house, which is why high demand from competitive homebuyers is such a win for this summer’s sellers.

Low Inventory of Houses for Sale

“For most sellers listing sooner rather than later could really pay off with less competition from other sellers and potentially a higher sales price… They’ll also avoid some big unknowns lurking later in the year, namely another possible surge in COVID cases, rising interest rates and the potential for more sellers to enter the market.”

Purchaser demand is so high, the market is running out of available homes for sale. Danielle Hale, Chief Economist at realtor.com, explains:

Real Estate Tip #12 – 3 Tips for Refinancing your mortgage, even with a bad credit score

A loan officer explains how to improve your credit and refinance your mortgage, plus how to make sure refinancing benefits you.

Updated 5 Hours AgoMegan DeMatteoGetty Images

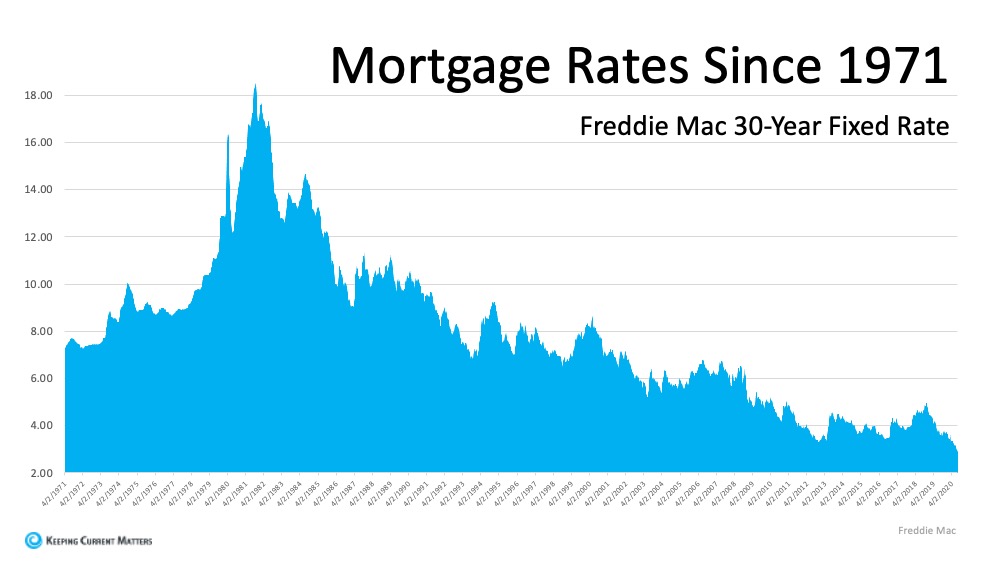

Mortgage rates have recently hit record lows, and many Americans are jumping at the opportunity to buy new homes as well as refinance.

According to the Mortgage Banking Association (MBA), mortgage applications have been surging since March 2020 when the Fed slashed interest rates in response to the coronavirus pandemic. By year-end, mortgage applications are expected to double in volume compared to economists’ original 2020 predictions.

Mortgage refinancing applications are also on the rise: Currently, Americans are applying for refinancing loans at a 38% higher rate than they were this time last year.

Refinancing your house means essentially taking out a brand new loan, often for the remainder that you owe on the property (but not always). Depending on how much equity you have in the house (i.e. what you’ve paid on it already) and what your credit score is when applying, refinancing might offer you one or more benefits, including:

- a lower interest rate (APR)

- a lower monthly payment

- a shorter payoff term

- the ability to cash out your equity for other uses

When you’re faced with economic uncertainty, refinancing your mortgage can help give you some breathing room. But at the same time, if you’re struggling financially, refinancing can be a little more complicated. If you have a bad credit score, you’ll need to take a few steps to ensure you can even qualify. And when you do qualify, you want to make sure your refinanced mortgage is better than your original mortgage, not worse.

Below, CNBC Select spoke with senior community development loan officer at Quontic Bank Darrin Q. English about what to keep in mind while refinancing your home with less-than-perfect credit. He shares 3 tips to keep in mind.

Real Estate #11 – What credit score is required to buy a house?

Prospective home buyers should aim to have this credit score to qualify for the best interest rates on mortgages. However, the minimum credit score requirements vary.

Updated Fri, Aug 7 2020Alexandria White

Getty Images

Credit scores typically range from 300 to 850, and borrowers within a certain range can qualify for mortgage loans. While you don’t need a perfect 850 credit score to get the best mortgage rates, there are general credit score requirements you will need to meet in order to take out a mortgage.

Prospective home buyers should aim to have credit scores of 760 or greater to qualify for the best interest rates on mortgages.

However, the minimum credit score requirements vary based on the type of loan you take out and who insures the loan. Of our list below, conventional and jumbo loans aren’t insured by the government and often have higher credit score requirements compared to government-backed loans, like VA loans.

Having a higher credit score makes a big difference in the amount of money you pay over the course of a loan. Borrowers with scores in the higher range can save thousands of dollars in interest payments over the life of a mortgage.

Current Buyer and Seller Perks in the Housing Market (as of 08/2020)

Today’s housing market is making a truly impressive turnaround, and it’s also setting up some outstanding opportunities for buyers and sellers. Whether you’re thinking of buying or selling a home this year, there are perks today that are rarely available, and definitely worth looking into. Here are the top two.

The Biggest Perk for Buyers: Low Mortgage Rates

The most impressive buyer incentive today is the average mortgage interest rate. Just last week, mortgage rates hit an all-time low for the eighth time this year. The 30-year fixed-rate is now averaging 2.88%, the lowest rate in the survey’s history, which dates back to 1971 (See graph below):This is a huge advantage for buyers. To put it in perspective, it means that today you can get a lower rate than any of the past two generations of homebuyers in your family if you decide to purchase at this time.

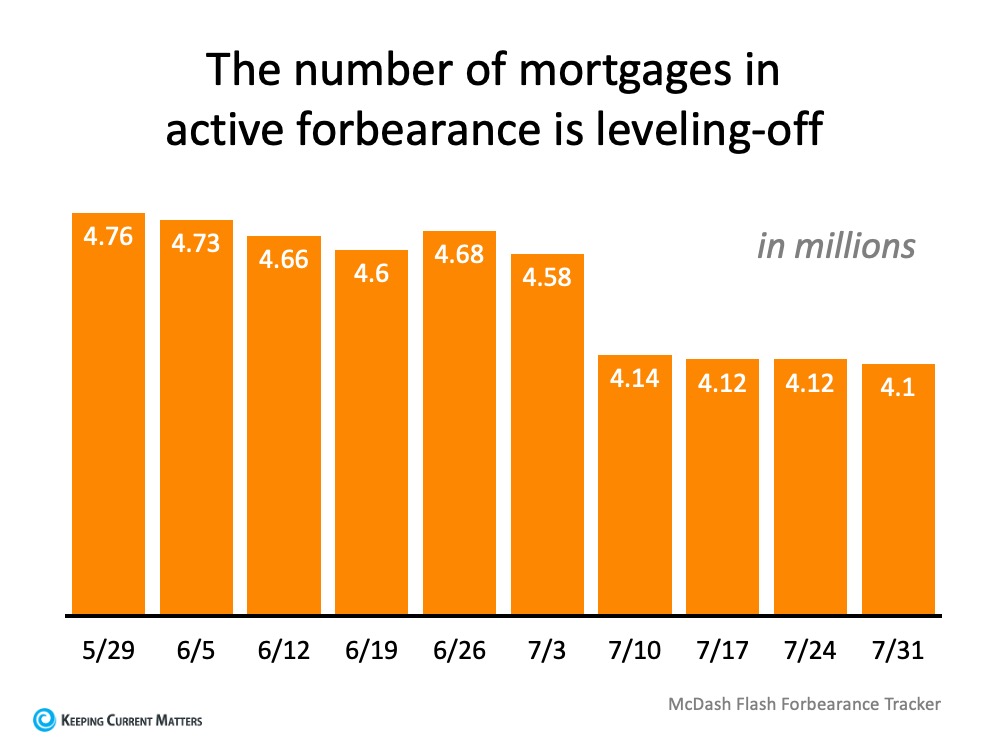

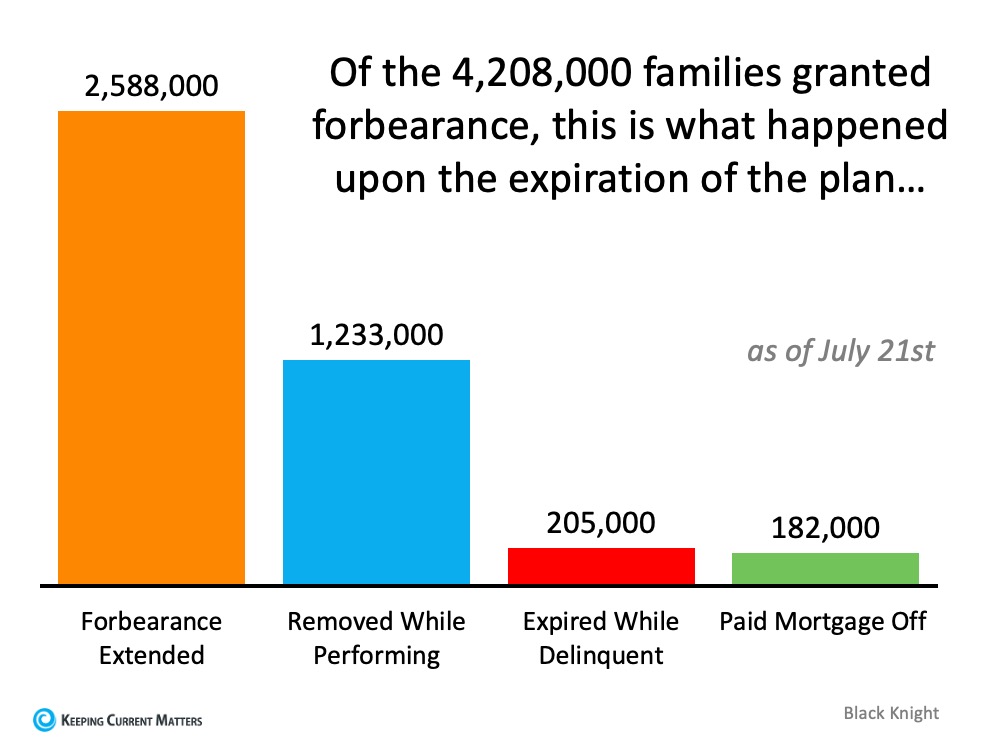

Why Foreclosures Won’t Crush the Housing Market Next Year

With the strength of the current housing market growing every day and more Americans returning to work, a faster-than-expected recovery in the housing sector is already well underway. Regardless, many are still asking the question: will we see a wave of foreclosures as a result of the current crisis? Thankfully, research shows the number of foreclosures is expected to be much lower than what this country experienced during the last recession. Here’s why.